What Is Home Equity and How Can I Use Mine in 2022?

Posted by admin on

Homeowners with mortgages saw their home equity blossom 31% in 2021, according to a report from CoreLogic, a remarkable increase for such a short period of time.

As you map out your plans for 2022, you may be thinking of ways to keep building more equity or use what you’ve recently acquired.

Should you get a home equity loan to pay for a much-needed vacation or your postponed dream wedding? What about tapping into those funds to pay for your basement remodel or to consolidate other debts?

Perhaps you’re looking to buy a home soon and want to know more about how to put your existing equity toward a new and spacious abode.

There’s quite a bit you should know about home equity, especially if you plan to borrow from it. Let’s take a look at what home equity is, how it grows over time, and why it’s so important to use it wisely.

What is home equity in simple terms?

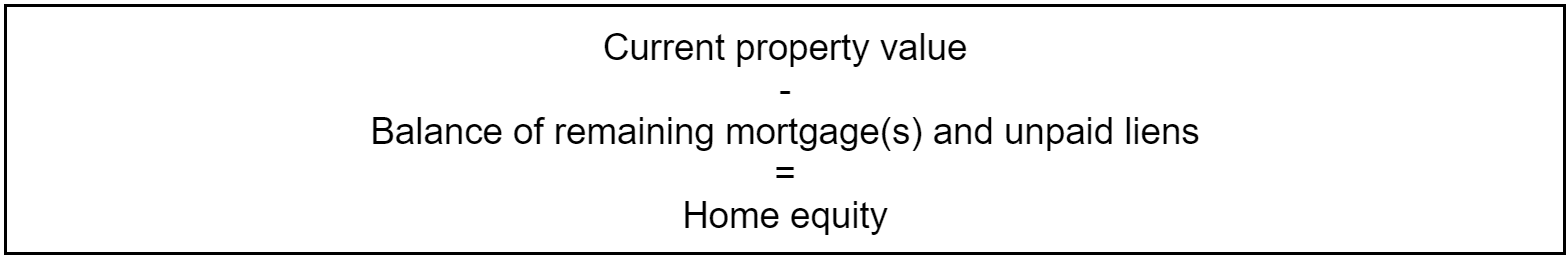

Home equity is a homeowner’s financial stake in their property that they own free of their mortgage loan obligation. It’s calculated by taking the current value of your home minus your principal balance and the total of any additional liens that must be paid off before selling the property.

How much equity do I have in my home?

These added liens could be in the form of a second mortgage, outstanding property taxes, or child support owed. But if you don’t have any additional liens to account for, simply take your home value minus your unpaid principal to estimate your home equity.

To calculate your home equity, you need the following:

- Your current home value

- The amount of your unpaid principal

Let’s break down how to obtain estimates of each figure.

What’s your home worth?

There are a few ways to find out what your home is worth today:

Online tool

Get an instant estimate of what your home is currently worth using a tool such as HomeLight’s Home Value Estimator (HVE).

Our HVE combs public data including tax records and assessments and pulls recent sales records for other properties in your neighborhood. Using a short questionnaire, we also factor in specifics about your home such as the property type and described condition.

Input your address, and we’ll provide you with a preliminary home value estimate in under two minutes. Although it’s not a guarantee of what your home will appraise for, an online home value estimator is a helpful starting point in your quest to determine how much equity you have.

To Calculate Your Equity, Start With a Home Value Estimate

We’ll provide you with a real-world home value estimate in 2 minutes that you can use to ballpark your home equity over time.

Local real estate agent

For a more precise calculation of your home’s worth, ask a real estate agent to provide you with a comparative market analysis (CMA), which uses comparable sales as a benchmark for your property value and then makes dollar adjustments based on competitive differences. Agents typically perform a CMA when they list a home, but may be willing to help you even if you aren’t selling right away.

Appraisal

A lender is typically going to require a professional home appraisal if you want to use a home equity loan, though methods like drive-by valuations or automated valuations models have become more common. Contact your lender for details about what your loan requires.

How much do you still owe?

The best way to determine how much you still owe on your mortgage is through your loan servicer. Many lenders today provide online tools to access the most recent details about your mortgage, including your payment history and copies of your monthly mortgage statement, in a secure online portal.

Look for a callout like “unpaid principal” which may be located next to instructions for getting an official payoff quote, which is the total amount of principal and interest you must pay to satisfy your loan obligation.

Got those numbers?

Time to see how much equity you have:

- Take your home value estimate from HomeLight’s Home Value Estimator tool. For a more precise home valuation, you’ll need to get an appraisal.

- Subtract your unpaid principal.

- If applicable, subtract the total of any additional unpaid liens. Do an online search by address through your county recorder, clerk, or assessor’s office if you believe you may have additional liens to account for.

- The remaining amount is an estimate of your home equity.

Does interest count towards equity?

Your home equity builds as you pay down the mortgage principal and as property values rise. But keep in mind: The money you pay toward mortgage interest doesn’t count toward your equity.

As you make mortgage payments every month, some of that payment goes toward your principal balance and some of it goes toward interest.

During the early days of paying your mortgage, that monthly payment covers just a small amount of principal (and is weighted heavily toward paying interest). But the slice that goes toward the principal gets bigger and bigger as you progress through the loan amortization schedule.

You can get an idea of how much of your monthly mortgage goes toward interest versus principal by looking at the amortization schedule for your loan, which the lender is required to provide a copy of when you take out a mortgage.

If you don’t have that copy handy, another option is to use an online amortization calculator for an estimate of how much you’ll pay in interest over the life of the loan and how it will change as you gradually reduce your debt.

Easy home equity example

Let’s say you bought a home in the Tampa/St. Petersburg/Clearwater, Florida area in December 2011 for $350,000. After a 20% down payment (or $70,000), your principal balance would be $280,000. At that point you have $70,000 in equity, the equivalent of your down payment.

For the next 10 years, say you make mortgage payments of approximately $1,257 a month for a 30-year fixed mortgage with an interest rate of 3.5%.

If the house were still worth $350,000 in December 2021, your estimated equity would be about $133,000 by paying down your mortgage balance alone and not accounting for price growth, according to an online mortgage calculator from HSH, a consumer mortgage resource since 1979.

Adjusting for current home appreciation, HSH estimates that the same home is now worth about $965,000, putting your current estimated equity at about $748,000. This example illustrates why Eli Joseph, a top-selling real estate agent in Hartford County, Connecticut, is passionate that “equity is a key, key, key component in building wealth.”

How equity builds over time

While building equity in your home doesn’t happen overnight, equity can grow in several ways. Here are some of the main factors that drive home equity.

When you make a down payment

Since equity is the portion of the property you own, free of financing, your down payment is considered equity. In our example above, a 20% initial down payment means you own 20% of the house at the time of purchase.

Naturally, the larger your down payment, the more equity you gain at the start, but you’ll have to weigh that against how much you can comfortably afford to put toward the purchase. A 15% or 10% down payment still earns you a chunk of ownership, but will typically require the extra cost of private mortgage insurance (PMI) if you took out a conventional loan.

When you make mortgage payments

For many borrowers, paying off a mortgage is a 15- or 30-year process. But it’s nice to think as you make those payments about the wealth that you’re accumulating each month. Homeowners who opt for 15-year mortgages tend to build equity faster because they typically make higher monthly payments and have lower interest rates.

Regardless of the type of loan you have, you can increase your equity faster by increasing your monthly payment and designating that those extra funds be applied to principal. On a fixed-rate loan, this also reduces the amount of total interest you’ll pay, since interest is calculated against the principal balance.

When property values rise

Property values historically appreciate over time, and one of the top advantages of homeownership is getting to build wealth through the upswings of the housing market.

Real estate is typically a safe investment, but there have been exceptions and bad moments. When there’s a high supply of housing and a low number of buyers, property values can remain stagnant or decrease, such as dropping 2.9% during the Recession of the 1990s and 12.7% during the Great Recession from January 2008 to January 2009.

Lately, however, values have been going up. Before the COVID-19 pandemic, the median sales price of existing single-family homes rose about 5% from 2018 to 2019, according to the National Association of Realtors® (NAR). It climbed about 9% from $274,600 in 2019 to $300,200 early in 2020, NAR statistics show, and has risen sharply since, thanks in part to a lower supply of available housing and high buyer demand.

When you add value through renovations

Most home renovations won’t recoup their cost dollar for dollar, but many do add significant resale value and taken together, can help a house stay current against new construction and upgrades going into neighboring homes. Generally upgrades that increase square footage or modernize a home are some of the best investments you can make. Examples may include:

- Finish the basement, which costs about $18,000 on average but recoups up to 70% of the cost at resale.

- Replace your existing entry door with a steel one, which costs about $200 to $400 and recovers up to 91% at resale.

- Replacing your garage door for about $200, recouping about 95% of your costs at resale.

- Do a minor kitchen remodel for about $21,000, replacing cabinet fronts and hardware, which recovers about 77% at resale.

Joseph, our top agent in Connecticut, says in his area, remodeling a kitchen or finishing a basement add tremendous value.

His mother finished the basement in her ranch home earlier this year and added a bathroom. Because of current home values and mortgage rates, she refinanced her mortgage, got rid of her PMI, and reduced her monthly mortgage payment by more than $200.

“Her home value increased and her mortgage payment decreased because she had more than 25% equity,” he says. “She can always sell at any time at a higher price than she bought.”

In the meantime, she’s enjoying her new space. “She just had a birthday party down there and invited a lot of friends over.”

4 options to use your home equity

Building equity gives homeowners the peace of mind and stability that renters often don’t have, Joseph says. Here are a few ways to use that wealth.

1. Sell your home and buy a new one

How much equity you should have before selling depends on your next move. Danny Freeman, a top-selling real estate agent in Memphis, Tennessee, suggests having 10% in equity if you’re simply relocating and a minimum of 15% if you want a larger home. “The more, the better,” because your sale price needs to pay off the existing mortgage, cover closing costs, and handle at least a portion of the down payment on a new home.

Ideally, you should have enough equity to cover all taxes (local, state, and federal), as well as attorneys’ fees, moving expenses, and any other costs you don’t want to pay out of pocket, Joseph adds.

2. Do a cash-out refinance of your current mortgage

With a cash-out refinance, you can tap into your equity and refinance your home with a larger mortgage, and the lender will advance you that additional amount in cash, which you can put toward remodeling costs or other expenses or to pay off higher interest debt such as credit cards and car loans. Most lenders will limit your cash-out loan amount to 80% of your home’s value.

What’s nice about this route is that a cash-out refinance is a standard first mortgage loan, not a secondary lien or line of credit, allowing you to take advantage of lower interest rates.

3. Use it toward your retirement

The most straightforward way to use your home equity for retirement is to downsize from your home and invest the proceeds, reducing your expenses (and again building equity with another mortgage). Reverse home mortgages can help supplement your retirement income while tapping into your existing home equity, but this option can make it difficult to leave your home to your children, among other risks.

4. Fund your next renovation project, consolidate debt, or pay for education

Using a home equity loan or home equity line of credit (HELOC), you can borrow money using the equity in your house as collateral for a number of expenses, including debt consolidation, tuition, renovation projects, or even a down payment on another property.

However, keep in mind that interest will only be tax-deductible if the borrowed funds are used to “buy, build, or substantially improve the taxpayer’s home that secures the loan,” according to IRS Publication 936.

Typically, you’ll need at least 10% equity in your primary home (or 20% in an investment property or second home) to qualify for a HELOC, but be careful how you spend the money. You’ll have to pay back whatever you borrow, plus interest, for this option.

A lot of people misuse the money. I know a lot of investors who do that — buy a house, refinance, buy another house … but it’s not necessarily the best route to go. Or using the money for just anything — a car, for example.

Eli Joseph Real Estate AgentClose

Eli Joseph Real Estate AgentClose Eli Joseph Real Estate Agent at eXp Realty5.0

Eli Joseph Real Estate Agent at eXp Realty5.0

- Years of Experience 5

- Transactions 129

- Average Price Point $189k

- Single Family Homes 115

The risks of dipping into your home equity

While it’s tempting to use your home equity to pay for home renovations, repairs, and other expenses, you could lose your home if you don’t repay what you’ve borrowed.

People unfortunately borrow against their house and then can’t pay it back, which makes it harder for them to sell. “A lot of people misuse the money,” Joseph says. “I know a lot of investors who do that — buy a house, refinance, buy another house … but it’s not necessarily the best route to go. Or using the money for just anything — a car, for example.”

Even without borrowing against your home equity, a homeowner can wind up with “negative equity,” or owing more on the mortgage than your home is worth. People also refer to this as being “upside down” or “underwater” in their mortgage, and this can occur because of an increase in mortgage debt or a decline in home value.

If you’re considering tapping into home equity to pay off debt or expenses not associated with purchasing another property, Joseph suggests finding other ways to come up with the money or taking out a smaller amount. Having a temporary job or taking out another type of loan that addresses these expenses offers more stability than borrowing against your house.

Home equity: the long game

It’s exciting to build wealth through homeownership, but remember that owning a house over time gives you the best chance of riding out any market fluctuations and covering inevitable selling expenses so you can reap the greatest rewards.

“Real estate is a long game. It definitely, definitely pays off,” Joseph says. “Five years goes by very fast. Even 15 or 20 years. Having a house and building equity over those years, even if you just own one property, can change someone’s life.”

Header Image Source: (Alexander Wark / Unsplash)